CTEK survey identifies continued appetite for electrical vehicle adoption

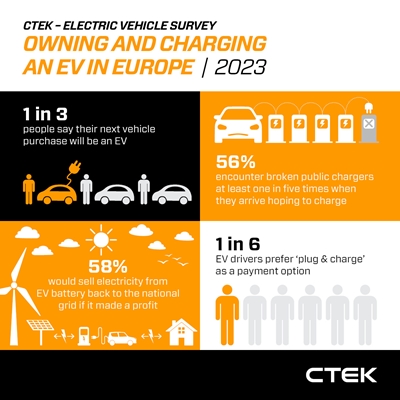

Europeans are keen to switch to Electric Vehicles (EVs) in huge numbers, with a CTEK survey by YouGov released today showing that one in three people (33%) plan to have a fully electric (BEV) or plug-in hybrid EV as their next vehicle.

But queues to charge and broken charge points are blighting EV driving, fuelling growing charger anxiety and increases in the proportion of people saying there is not enough charging infrastructure in their countries.

The 33% of respondents who plan to buy EV next are from the five European countries surveyed by YouGov for the vehicle charging brand CTEK and almost equal the 34% who said their next purchase will be an Internal Combustion Engine (ICE) petrol or diesel vehicle.

New EVs are set to outsell new ICE vehicles by two to one. Some 10% of people said they will buy a new Battery Electric Vehicle (BEV) and 9% a new Plug-in Hybrid Vehicle (PHEV), compared to 9% who said a new ICE.

For used vehicles, ICE (26%) remains ahead of EVs (15%), but 79% of current EV owners will buy electric again whilst only 45% of current ICE owners will stick with petrol or diesel and 31% will buy an EV.

In CTEK’s third annual EV survey, more than 11,000 people were questioned by YouGov in the UK, Sweden, Norway, France and the Netherlands. Asked if EVs are the future of road travel, 55% agreed. In 2022 that figure was 47%. And 61% of EV drivers said EVs are cheaper to run than ICE vehicles.

Asked that if their EV and home charger enabled it, would they sell electricity from their EV battery back to the national grid if it made them a profit, 58% said yes and another 18% did not know.

Whilst the intention to go electric is strong, the survey identifies problems with public charging provision.

Insufficient public charging is fuelling growing anxiety over topping up an EV’s battery. The 2023 survey found 68% of people saying EV drivers have charger anxiety, up from 59% in 2022. And 74% said there is not enough charging infrastructure, up from 62% in 2022.

More than half of EV drivers (55%) now encounter broken public chargers at least one in five times when they arrive hoping to charge. An astonishing one in 25 EV drivers (4%) said charge points are always broken.

They are most often broken in France and the UK (where 62% and 50% respectively said they encounter them at least one in four times) and least often broken in Norway, where 14% of drivers say they never encounter broken chargers. In France, this figure is just 4%.

Almost three fifths (58%) of EV drivers have to wait to use a public charger at least one in five times; 4% say it is now every time and only 12% never have to queue. Broken chargers and queues are most often found at destinations such as shopping centres, car parks and highways.

The survey found EV drivers want simpler ways to pay for public charging. One in five (21%) have five or more EV charging apps on their phone and one in four (25%) have five or more RFID tags or cards.

Instead, EV drivers said their top three ways to pay would be: one app for all charge points, known as e-roaming (the preferred choice for 19%); tapping a bank card (18%); and ‘plug & charge’ (17%), the ISO15118 standard where the car and the charge point communicate automatically with payment taken from the account linked to the EV’s owner.

When asked where they would like to charge, 60% of EV drivers said at home. But with many homes unsuitable for home charging, such as flats or houses without driveways, other charging options are essential as EV ownership grows.

Three out of ten EV drivers (30%) said they would like to charge on the highway, 25% said at work (up from 14% in 2022), and 18% at a destination (12% in 2022). Preferred destinations to charge at include supermarkets, shopping centres and places to eat or drink.

When asked about the likelihood of certain factors to make them buy an EV, 50% of non-EV drivers said they’d be more likely to purchase such a vehicle if there were more highway chargers. 48% of working non-EV drivers would be persuaded by workplace charging.

For other factors tested, destination charging would make 45% of non-EV owners more likely to get an EV; 43% would be influenced by public charging in their neighborhood and 42% by a charging unit at home.

Cheaper EVs to buy was the single most stated measure that would encourage current ICE drivers, with more than half (51%) saying a lower purchase price would help.

CTEK’s YouGov survey revealed differences between the genders – double the number of men than women drive a BEV (Battery Electric Vehicle) or a PHEV (Plug-in Hybrid Electric Vehicle). And men are almost twice as likely as women to buy a BEV next.

Cecilia Routledge, CTEK’s Global Director Energy and Facilities, said: “Our annual YouGov survey shows a strong demand from both existing EV owners and ICE drivers to buy electric as their next vehicle – both new and used.

“The charging sector and national and local government need to work harder on expanding and maintaining the charging infrastructure to reduce the frequency of broken chargers and queueing.

“If EV ownership expands in line with our survey results there must be many more additional opportunities to charge at destinations, workplaces, car parks and on highways. And they must work and the charging be easier to pay for.

“What should excite everyone in the charging sector, in governments, in energy generation and at transmission authorities is how open people are to the idea of Vehicle to Grid (V2G) flows of power to reduce peak demand and help us all on the road to net zero.”

ENDS

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 11,176 adults in the UK, Netherlands, Sweden, Norway and France. Fieldwork was undertaken between 13th - 24th April 2023. The survey was carried out online. The figures have been weighted and are representative of the adult population (18+) for each country.